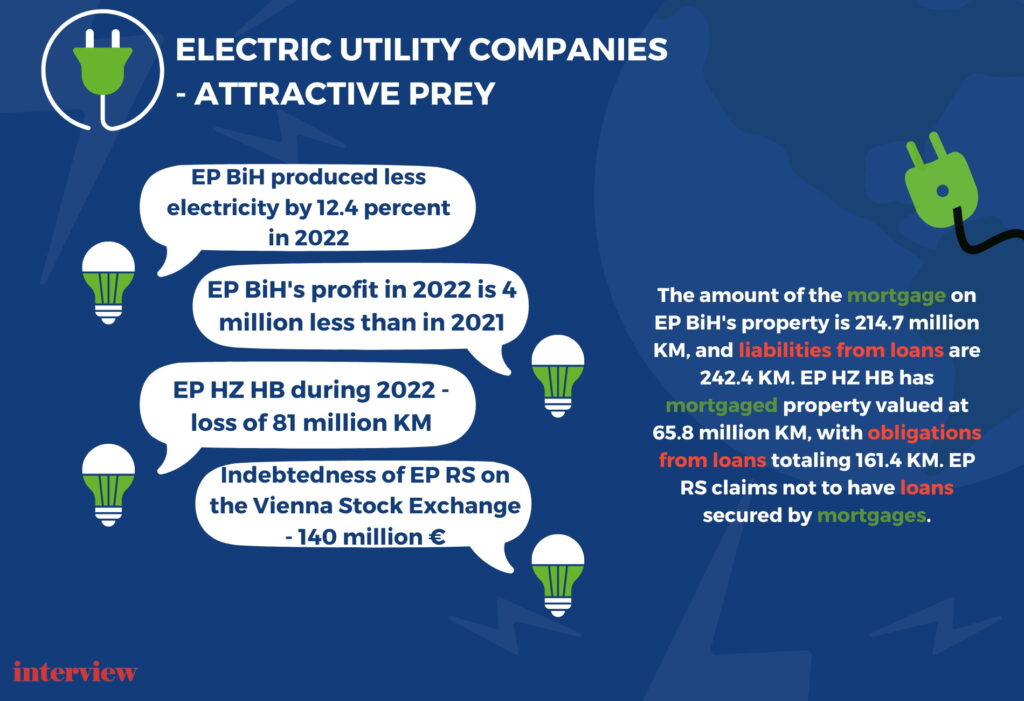

MOSTAR – Almost 300 million worth of assets are in danger. Lack of due diligence by the management, the ministry, the government and the Board. Electric utility companies were a tempting prey to all

The mortgages used by the electric utility companies in the Federation of Bosnia and Herzegovina to secure loans from banks are a threat to the assets of these companies, worth close to BAM 300 million- both electric utility companies have a large number of loans, and over the last few years they have experienced a decline in revenues, economic experts are warning.

“Responsibility for such business results is formally borne by the management of these companies, but essentially by the competent ministries and government that appoints the Boards”, warns economic expert Admir Čavalić, president of the Committee for economic and financial policy of the House of Representatives of the FBiH Parliament.

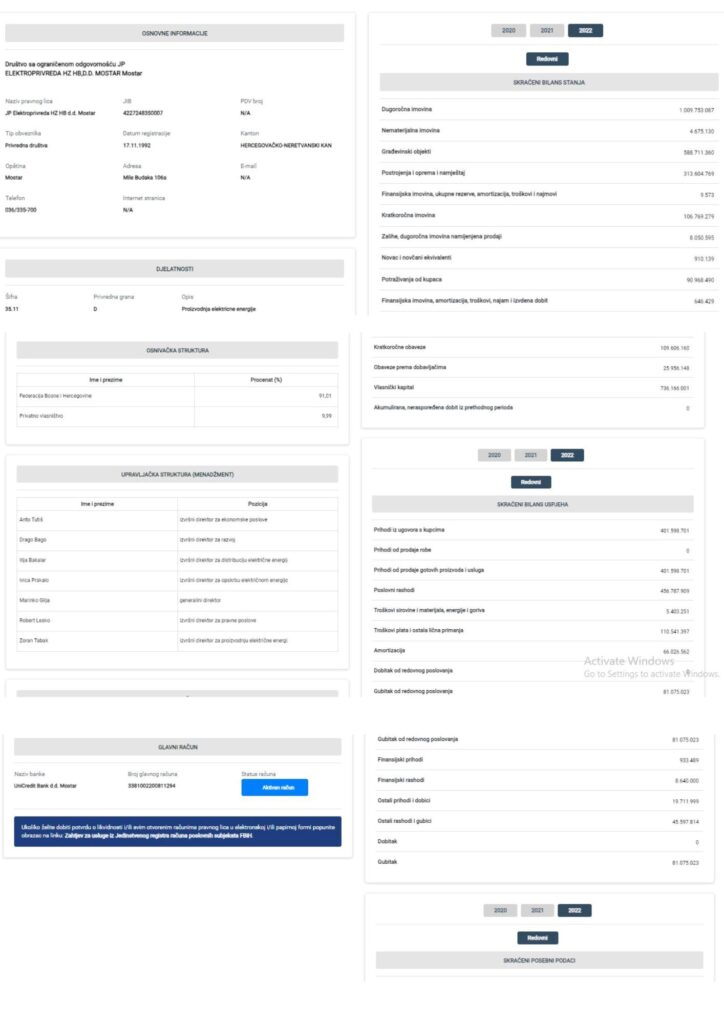

Namely, the Audit office of the institutions in FBiH established that the Public enterprise HZHB has mortgaged an office building in Mostar, valued at BAM 65.8 million for BAM 65 million loan from UniCredit Bank, and EP BiH mortgaged assets whose value was estimated at BAM 241.7 million.

Once it is too late

EP BiH did not respond to the inquiries of interview.ba portal as to which assets are mortgaged and with which bank. However, some members of the FBiH Parliament have warned earlier that the office building of EP BiH is mortgaged by a consortium of banks consisting of Sberbank BH, Intesa Sanpaolo Bank BiH and NLB Bank.

“Elektroprivreda BiH (electric utility company) pledged assets for the loans related to realization of the construction of Block 7 in the Tuzla Thermal Power Plant. We know now that this project is not happening. It was also confirmed by the FBiH Government, so the risks related to the given mortgages are increasing and I expect problems in this regard. The main issue is the fact that we don’t have transparent communication about the project and the loan. I am afraid that crisis communication about this topic will commence once it is too late and the damage is already done. Decline of revenues, as seen from the audit reports, for both electric utility companies, PE HZHB and PE BiH, poses an exceptional problem for which no solution is in sight. That will most likely complicate the situation with loans, especially the ones secured by mortgages “, warns Čavalić.

A double-edged sword

But, economic expert Aleksandar Draganić believes that “a loan is a double-edged sword, but that the risk is not too high since these companies will always produce and sell electricity, and the banks know that they must exist.”

“Bank would have given loans to these companies even without a guarantee. I believe it was done pro forma; I do not believe there is any risk. Furthermore, banks know that they can block accounts of these companies at any moment and collect their dues. When it comes to the assets – they can mortgage their assets if they have decisions of the internal bodies and surveys. The true ownership is the genuine problem, since the assets haven’t been registered, it hasn’t been defined what belongs to whom. There is, however, another problem – according to the old Public Procurement Law the loans had to be sought through public procurement procedure since it is procurement of money. But, if you begin a process to collect bids for a certain amount of money under certain conditions you will not be able to observe the agreements with your banks. A third bank may appear, and that is a problem”, explains Draganić.

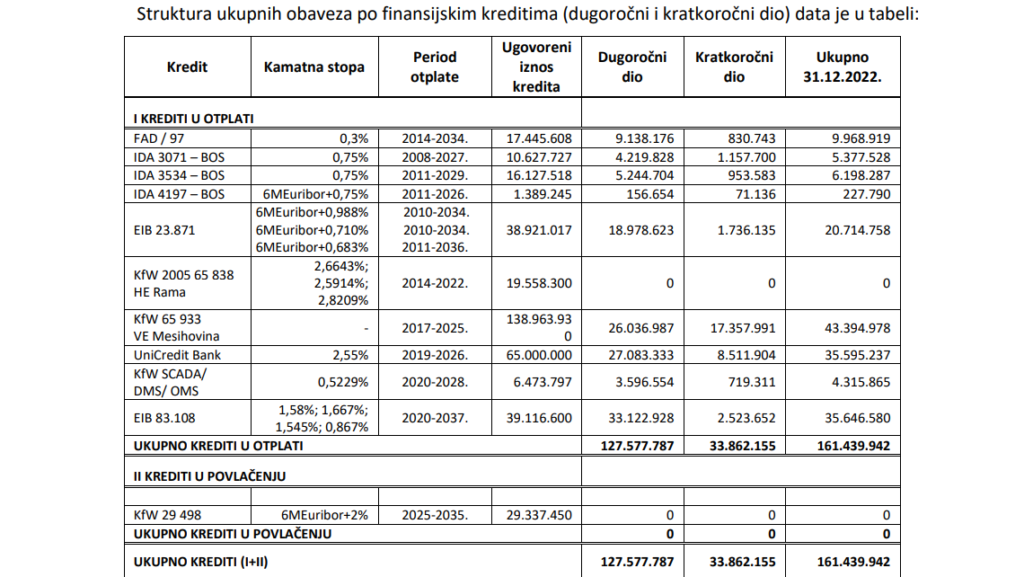

According to the audit report on operations of PE HZ HB in 202 , this company had loan commitments in the amount of BAM 161.4 million at the end of the year.

“Loans are contracted in EUR, except for loans from the International Development Association – IDA, which are contracted in SDR. Contracts with creditors were concluded by Bosnia and Herzegovina, and the Company concluded subsidiary contracts with the Federation of Bosnia and Herzegovina in accordance with the host contracts. During the year, debt to the Federation Ministry of Finance was serviced based on the amortization plans, except for the loan of the UniCredit bank”, wrote the auditors.

Losing money, but increasing salaries

The report also reads that in 2022 the PE HZ HB had a decline in revenues compared to previous years, which resulted in a loss of BAM 81 million, while the costs of salaries and other personal incomes were 7.4 million higher than a year before.

In addition, they purchased the electricity at an average price, which is higher than the average selling price.

The auditors’ conclusion is that “The company cannot settle current liabilities (BAM 109.606.160) with current assets (BAM106.769.279)”.

It was also concluded that the accumulated (undistributed) loss of this company is BAM 104.771.260.

On the other hand, buyers owe almost BAM 387 million to this company, namely Aluminij d.d. Mostar (292.929.132), Clinical Hospital Mostar (19.785.813) P.S. Vitezit (5,495,498) Water company Mostar (2,479,021), but also GEN-I d.o.o. Sarajevo (17,083,098 KM), Interenergo d.o.o. Sarajevo (10,731,004 KM), Danske Commodities BH d.o.o. Sarajevo (4,661,900 KM), HSE BH energy company d.o.o. Sarajevo (4,059,253 KM), PE Elektroprivrede BiH d.d. Sarajevo (2,735,383 KM). (As a reminder, the management of PE HZ HB had settled Aluminijum’s debt in 2020 – more than BAM 99 million – by reducing the value of the company’s capital.)

According to the data of the Financial Intelligence Agency FBiH , PE HZ HB had revenues of 401.6 million in 2022, expenditures of 456.8 million and ended the year with a loss of BAM 81 million.

Mortgaged real estate

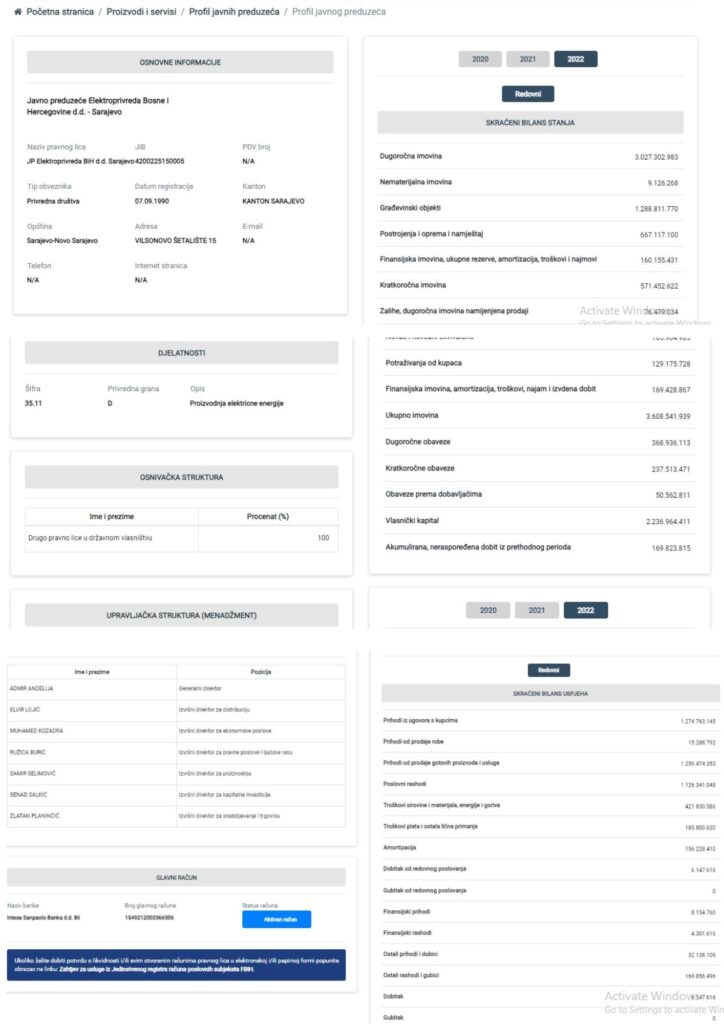

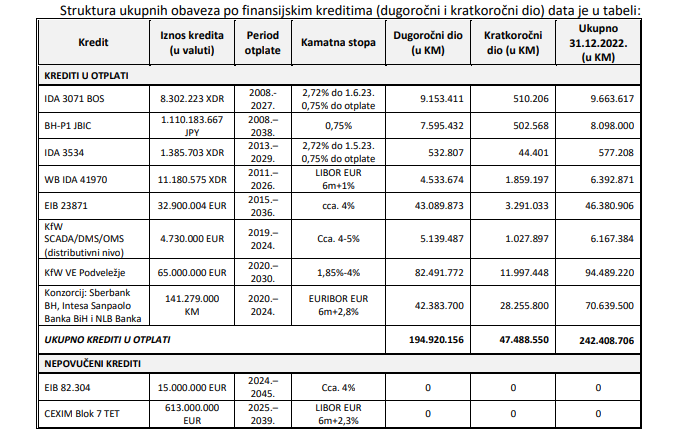

At the end of 2022, the EP BiH had total loan liabilities of BAM 242.4 million – the long-term part of BAM 194.920.156 and the short-term part of BAM 47.488.500, which mostly relate to financing the renovation and revitalization of production, transmission and distribution capacities; construction of new production facilities and facilities for the transmission and distribution of electricity.

“Contracts with creditors were concluded by the state of Bosnia and Herzegovina, and the Company concluded subsidiary contracts with the Federation of BiH, taking over all conditions from the host contracts… Loan liabilities towards the consortium of banks Sberbank BH, Intesa SanPaolo Banka BiH and NLB Banka are settled directly with the creditors “, is also one of the auditors’ conclusions.

It is also noted that “The Company pledged real estate with an estimated market value of approximately BAM 214.689 thousand in order to secure the return of borrowed funds, which mostly relate to the implementation of the Block 7 construction project at the TPP Tuzla”.

The auditors did not miss the fact that investments in the amount of BAM 94.530.543 were shown for the construction of Block 7 of the Tuzla Thermal Power Plant under the heading “Ongoing investments”.

However, the implementation of this contract was suspended even though an advance payment in the amount of BAM 211.917.603 was made, and the Company is indebted to foreign and domestic banks in the total amount of BAM 1.342.144.929.

That is why they draw attention to the need to urgently resolve the status of this investment in accordance with the concluded contract, the delay of which may cause damage and additional costs for the Company as the carrier of the activity.

Debts, promises

The revenues of EP BiH in 2022 were BAM 1.3 billion (BAM 90.76 million from exports), which is less than the planned 1.4 billion, but more than BAM 1.119 billion from 2021. However, the profit in 2022 was about 4 million less than in 2021. At the same time, less electricity was produced in 2022 than in 2021 (12.4 percent less) and less than planned for 2022 (7.7 percent less), but more electricity was sold than it was produced, which implies the purchase of electricity on the market. The number of buyers in 2022 was 797.260, which is 9.092 buyers more than the previous year.

Buyers owe this company BAM 129 million, whereof 108 million is owed by the buyers in BiH: Arcelor Mittal d.o.o. Zenica (BAM 9.872.897), Alpiq Energija BH d.o.o. Sarajevo (BAM 2.475.595), District heating Zenica d.o.o. Zenica (BAM 2.193.387), GEN – I d.o.o. Sarajevo (BAM 1.620.326), Metals company Ilijaš d.d. Ilijaš (BAM 993.624), PE Railways of the Federation of BiH d.o.o. Sarajevo (BAM 988.285), Cement factory Kakanj d.d. Kakanj (BAM 976.293), PE Elektroprivreda HZHB d.d. Mostar (BAM 995.856).

According to the data of the Financial Intelligence Agency FBiH, the EP BiH ended the year 2022 with revenues of BAM 1.3 billion and expenditures of 1.13 billion, and profit of BAM 6.1 million.

Over-indebtedness in RS

Elektroprivreda Republika Srpska, which is a holding company made up of several companies, say that they do not have loans secured by mortgages, but all the available data indicate that they are over-indebted.

“The only big loan that we have, and that we got from Chinese creditors, was secured by a guarantee of the Republika Srpska Government”, said for interview.ba Luka Petrović, director of this company.

No detailed audit

There are no details about their business operations because the Audit Office in RS did not audit the holding’s business operations as a whole.

However, it was announced in the official gazette of Bosnia and Herzegovina number 49 from 2023 that the State Aid Council of Bosnia and Herzegovina assessed that the guarantee for long-term borrowing by issuance of own bonds in the amount of BAM 32.8 million that the Mixed holding “Elektroprivreda Republika Srpska” Parent company a. d. Trebinje – Subsidiary company “Elektrokrajina” a.d. Banja Luka received from the Ministry of Finance and the Ministry of Energy and Mining of Republika Srpska “is not in accordance with the Law on the State Aid System in Bosnia and Herzegovina”.

It was then that the changes to the guarantee were requested, and according to media reports from 2021. Elektroprivreda Republika Srpska borrowed 140 million Euro at the Vienna Stock Exchange througha bond issue. The guarantor was the RS Government.

One bond issue after another

For clarification purposes, Elektroprivreda RS is a mixed holding made up of 11 companies: HPP on Trebišnjica, HPP on Vrbas, HPP on Drina, Mine and TPP Gacko, Mine and TPP Ugljevik, Elektro-Hercegovina, Elektrodistribucija Pale, Elektro Bijeljina, Elektro Doboj, Elektrokrajina and Research and Development Center for Energy Istočno Sarajevo.

According to the data of the RS Securities Commission Elektrodistribucija Pale had in 2022 alone borrowed BAM 5 million through a bond issue, and HPP Trebišnjica borrowed BAM 280 million (through a second bond issue). According to unofficial information, the company Mine and TPP Ugljevik was recently rejected for a loan because it was assessed as uncreditworthy.

Subsidiary companies

The editor of the Capital.ba portal, Siniša Vukelić, explains to Interview that Elektroprivreda RS as a central office cannot even have loans because it has no assets, but that the subsidiary companies are in trouble.

“Subsidiary companies also take loans for operating expenses, but for larger borrowing they ask for guarantees from the RS Government because banks or creditors no longer want to give loans to them, they do not believe that they can pay them back”, said Vukelić.

The last available data on the business operations of this company on the website of the Agency for Intermediary, IT and financial services are from 2016.

In addition to all this, all electric utility companies are burdened by a large number of lawsuits seeking millions in settlement and uncertain outcomes, and no matter how much it seems that electric utility companies in Bosnia and Herzegovina are still the dominant suppliers of electricity, very soon a power exchange will be established in Bosnia and Herzegovina, and clients will be able to buy it elsewhere, which could make the position of these companies even more difficult.

“There are risks for both electric utility companies in FBiH and it is necessary to take care of these mortgages, especially if we take into account the energy crisis we are witnessing and the impossibility to appropriately restructure these companies”, warns Čavalić. Interview